At a time of sticky inflation and a softening job market, extra money in the bank can serve as a lifeline for many consumers. Yet 8 in 10 Americans did not increase their emergency savings this year, a new Bankrate survey found, leaving them in no better financial position to…

While the top ten largest credit unions still hold significantly less in assets than even the top five largest banks, they have been growing considerably in recent years. Just within the last five years, total assets in federally insured credit unions have risen by approximately 45 percent over the past…

Key Takeaways: Transition Challenges: Veterans face unique financial challenges when transitioning from military to civilian life, including employment hurdles, healthcare costs, and housing instability. Employment and Economic Stability: Despite strong leadership skills, veterans often encounter unemployment or underemployment due to skill mismatches. Support from programs like VETS and the GI…

Key takeaways Most unemployment payment delays happen due to missing information, fraud checks, or system backlogs. You can often fix the issue by verifying your ID, submitting missing documentation, or updating your payment profile. While you wait, contact lenders to negotiate temporary relief and use savings accounts or short-term loans…

Personal Finance

The nation’s 75 million Social Security recipients will receive a 2.8% cost of living adjustment (COLA) increase in their benefits…

Historically Black colleges and universities are on the frontlines of the One Big Beautiful Bill Act’s new limits on parent…

The big new fees JPMorgan Chase is planning to charge some financial technology companies may well trickle down to consumers,…

With artificial intelligence beginning to eat away at many white-collar entry-level jobs, and the unemployment rate for recent college graduates…

Featured Articles

Reaching age 65 doesn’t automatically change how the IRS taxes your 401(k) withdrawals. Instead, it taxes distributions from a traditional 401(k) as ordinary income, just like wages or Social Security benefits. Your tax rate depends on your total taxable income and filing status in the…

Dept Managmnt

The Downsides of Credit Card Churning and Why It Is Risky You may be asking yourself, “Those benefits sound great, why is credit…

Banking

The fundamental flaws in the way the Federal Reserve operates these days were on full display Wednesday when Jerome Powell talked to the…

Credit Cards

All News

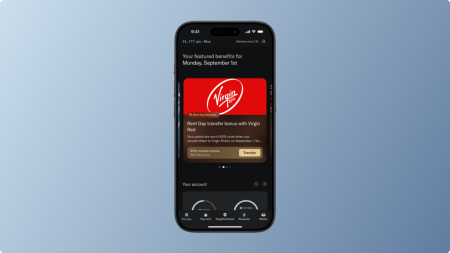

Each month on Rent Day, Bilt delivers a new set of bonus opportunities for Bilt Mastercard® cardholders and members. Offers range from earning bonus points to exclusive experiences just for members. In celebration of September Rent Day, Bilt Rewards members can enjoy up to a 100 percent transfer bonus with…

FG Trade Latin/Getty Images Key takeaways A financial coach is an expert who helps clients understand money matters such as budgeting, saving, and managing debt. Financial coaches can help you understand the basics of certain financial topics, but typically aren’t certified to provide specific investment advice like a financial advisor…

Any number of reasons might prompt you to close a bank account, but there are a few important steps to take before you sever ties with your financial institution. The steps to close a bank account may include setting up your direct deposit, recurring transfers and scheduled payments with another…

Key takeaways Discover offers a variety of flat-rate and bonus category credit cards that earn cash back or miles on your purchases. All Discover cards are eligible for the first-year Cashback Match bonus, through which Discover will match all your earnings at the end of the first year. The value…

Photography by Getty Images Key takeaways Preferred credit cards are designed for individuals with good to excellent credit scores who want to enhance their credit card rewards. These cards usually have annual fees, but the benefits and rewards can often offset the cost. Preferred credit cards are different from premium…

Key takeaways A financial counselor helps people with core financial tasks such as budgeting, saving and debt management. Many financial counselors charge hourly or flat fees. However, some are available for free through public services. Financial counselors and financial advisors both develop budgets and spending plans for clients, but financial…

d3sign/ Getty Images; Illustration by Austin Courregé/Bankrate Key takeaways Many mortgage lenders work with self-employed borrowers, and some even specialize in loans for them. Like any other borrower, you’ll need to meet credit and other requirements to qualify. To apply for a mortgage as a self-employed borrower, you’ll need to…

Key takeaways Investment advisors provide advice to clients on managing short- and long-term investments such as stocks, bonds and mutual funds. Investment advisors differ from financial advisors in terms of their roles, regulations, client types, and fee structures. Types of investment advisors include asset managers, portfolio managers, wealth managers, and…

Bloomberg / Contributor / Getty Images Prediction markets are a fascinating way to harness expert knowledge, helping publicize insight that might otherwise remain private. These markets give experts a financial incentive to make their information public or even for non-experts to bet on specific outcomes, such as an election or…

Key takeaways The main examples of tax-free investments are municipal bonds and tax-exempt money market funds. Other investments have partial tax breaks, such as Series I and EE savings bonds and Treasury bills. Tax-advantaged accounts, such as a Roth IRA, can often provide bigger tax savings than chasing tax-free investments.…

Editor's Pick